While crypto enthusiasts have spent years decrying regulatory uncertainty as the industry’s primary obstacle, 2025 has delivered the peculiar spectacle of governments actually providing the clarity they demanded—only to reveal that steering a complex patchwork of conflicting jurisdictional approaches might be more challenging than the previous vacuum of guidance.

The United States has finally abandoned its tiresome “regulation by enforcement” approach, with the CLARITY Act emerging as a legislative milestone that assigns regulatory responsibility based on asset type—effectively ending the tedious SEC versus CFTC turf wars that resembled academic departmental disputes over parking spaces. This bipartisan breakthrough has coincided with a remarkable 260% surge in Real World Asset token market capitalization, reaching $23 billion as institutional investors discover they can actually determine which regulator might potentially prosecute them. The legislation establishes dual registration pathways that allow platforms handling both digital commodities and tokenized securities to register with one or both agencies depending on their business model.

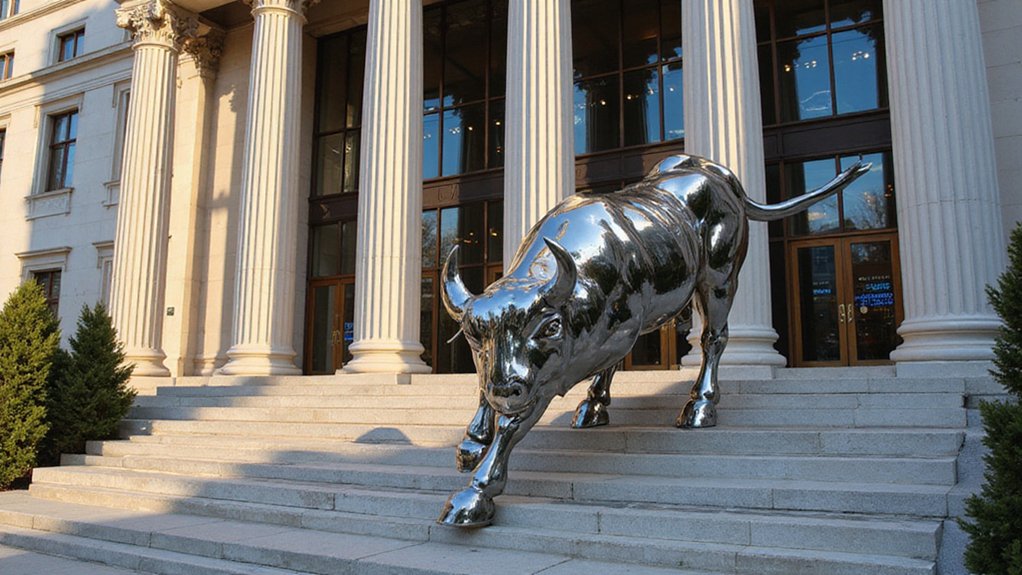

The crypto industry finally got the regulatory clarity it demanded, only to discover that knowing which agency might prosecute you counts as progress.

Meanwhile, the European Union‘s Markets in Crypto-Assets Regulation (MiCA) represents an ambitious attempt to harmonize crypto rules across member states, though its adjustment period has generated the predictable irony of creating uncertainty while ostensibly eliminating it. The regulation addresses consumer protection and market integrity with characteristic European thoroughness, yet implementation delays continue affecting adoption timelines across the continent.

Asia-Pacific jurisdictions have embraced a more pragmatic approach, with Hong Kong positioning itself as a regional digital asset hub through extensive licensing frameworks for exchanges, custody, and over-the-counter trading. Singapore has similarly finalized stablecoin regulations while maintaining its characteristically rigorous licensing regime that balances innovation with investor protection—a diplomatic feat that would impress seasoned international negotiators.

The global regulatory landscape now resembles a complex chess game where El Salvador and the Central African Republic have embraced Bitcoin for economic development, China maintains its stringent crackdowns with almost artistic consistency, and various jurisdictions compete for crypto business through increasingly sophisticated regulatory frameworks. Despite widespread concerns about crypto criminality, illicit activity represents only 0.14% of transactions, demonstrating that blockchain transparency actually provides superior visibility compared to traditional financial systems.

This newfound clarity has demonstrably improved investor confidence and driven institutional participation, enabling new asset classes on blockchain while supporting infrastructure development. The regulatory progress has accelerated mainstream Bitcoin adoption globally, though managing the resulting jurisdictional complexity requires legal expertise that would challenge international trade lawyers—proving that careful consideration of one’s wishes remains eternally relevant advice. Emerging Layer 1 blockchains with capabilities like ultra-high throughput and fast block times are positioning themselves to serve as foundational infrastructure for compliant Web3 applications in this increasingly regulated environment.