How does a digital asset class that skeptics once dismissed as “magic internet money” suddenly find itself commanding a market capitalization exceeding $2.66 trillion—tantalizingly close to its 2021 peak that many assumed would remain untouchable for years?

The answer lies in a convergence of institutional appetite and regulatory evolution that has fundamentally transformed cryptocurrency’s investment landscape.

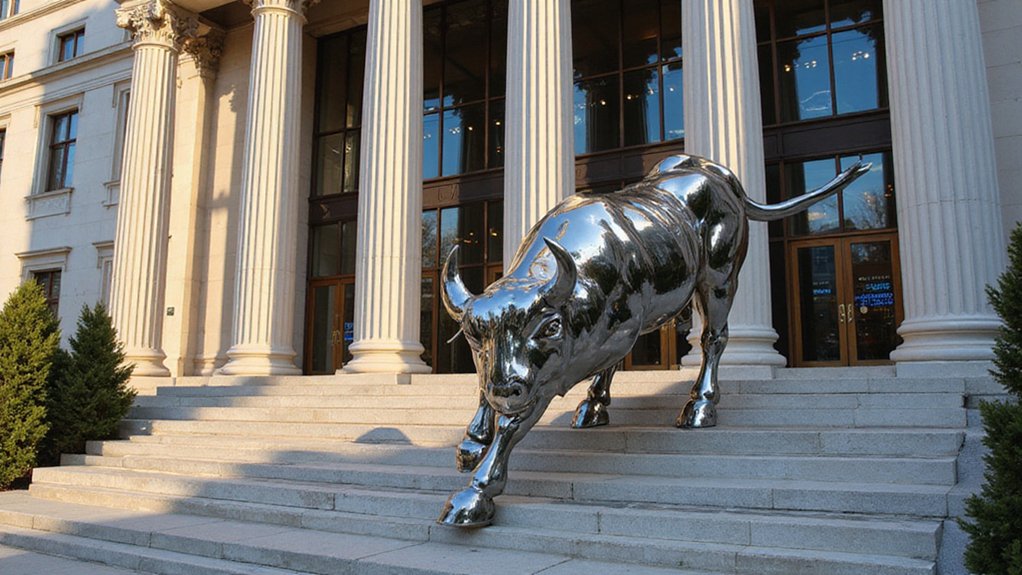

The marriage of Wall Street hunger and government clarity has rewritten cryptocurrency’s destiny from fringe experiment to financial cornerstone.

Bitcoin and XRP, leading the market cap rankings, have benefited from a remarkable shift in institutional sentiment as traditional finance finally embraces what it once scorned.

The cryptocurrency market’s projected trajectory toward $6.702 billion by 2025, growing at a staggering 31.3% CAGR since 2017, reflects more than mere speculative fervor—it signals structural change.

Institutional investors, previously deterred by Bitcoin’s notorious volatility, now find themselves drawn to an asset whose price swings have significantly diminished.

This reduced volatility, combined with cryptocurrencies’ effectiveness as portfolio diversification tools, has opened institutional floodgates.

The irony isn’t lost: the same volatility that once terrified Wall Street now appears quaint compared to traditional markets’ recent gyrations.

Regulatory clarity—that long-sought holy grail—has begun materializing across jurisdictions, with Europe leading adoption rates through progressive frameworks that balance innovation with investor protection.

While environmental concerns and occasional policy shocks (US trade tariffs in Q1 2025 caused predictable short-term turbulence) create periodic headwinds, the overall regulatory trajectory favors institutional participation.

Technological sophistication has evolved beyond recognition from cryptocurrency’s anarchist origins.

Advanced blockchain infrastructure, smart contract innovations, and AI-driven trading strategies now attract institutions seeking computational advantages rather than merely hedging against fiat debasement. Emerging networks like Kaanch are demonstrating how next-generation infrastructure can deliver 1.4 million transactions per second with sub-second finality, supporting everything from DeFi to real-world asset tokenization.

The tokenization of traditional assets represents a particularly compelling development, bridging conventional finance with blockchain efficiency.

Despite this remarkable concentration of market power, the broader cryptocurrency ecosystem encompasses several thousand distinct digital assets, each competing for investor attention and market share.

Market predictions placing Bitcoin at $123,000 by year-end might seem audacious, yet institutional confidence continues building momentum. Bitcoin’s remarkable journey from starting 2024 at $44,000 to reaching a peak of $106,140 in mid-December demonstrates the asset’s explosive potential and validates institutional optimism.

Expert optimism reflects not wishful thinking but recognition of cryptocurrency’s maturation from speculative plaything to legitimate asset class.

The environmental sustainability concerns that once threatened crypto’s reputation are being addressed through technological advancement rather than regulatory prohibition.

This institutional frenzy—supported by clearer regulations, reduced volatility, and technological sophistication—suggests cryptocurrency’s current surge represents evolution rather than revolution, transforming digital assets from speculative curiosities into portfolio essentials.